February 2020 - #FullMonzo

It’s been one month since I went #FullMonzo, I’m thinking of periodically writing posts on my findings both in my own spending habits, but also in how I’m using Monzo to better manage my money.

Since going #FullMonzo at the end of January 2020, it’s been really eye-opening to easily be able to see what sort of things I spend my money on, as well as fun and helpful tinkering with options within Monzo and some connected services.

App usage observations

The good: 👍🏻

The salary sorter is a very useful tool to put money into the various pots I want it in when my salary comes in. I thought I wanted this to be automatic (so it happens without any interaction on my part), but I think in reality I like that I control it with a few button clicks, it’s not much work.

The ‘Bills’ pot has been the single best thing I’ve done since switching to Monzo. Having a pot with money set aside for bills after using the salary sorter to move money into it has changed how I think about the money in my account. Being able to look at the money in my account and not do the mental arithmetic to think “okay, so I have £X in my account, but I have £Y and £Z payments coming up so I need to take those off to work out what I actually have left to spend” is great. What’s in my account is available to spend, as bills and recurring payments are covered with the money set aside.

I like having the committed spending as a separate section in the summary page, as that’s not necessarily spending I can control as easily as the rest of my monthly ad-hoc spending on my card. Having it separated helps maintain my mental model that it’s a separate thing.

Using IFTTT (covered later in this post) has been a fun experiment!

The not-so-good: 👎🏻

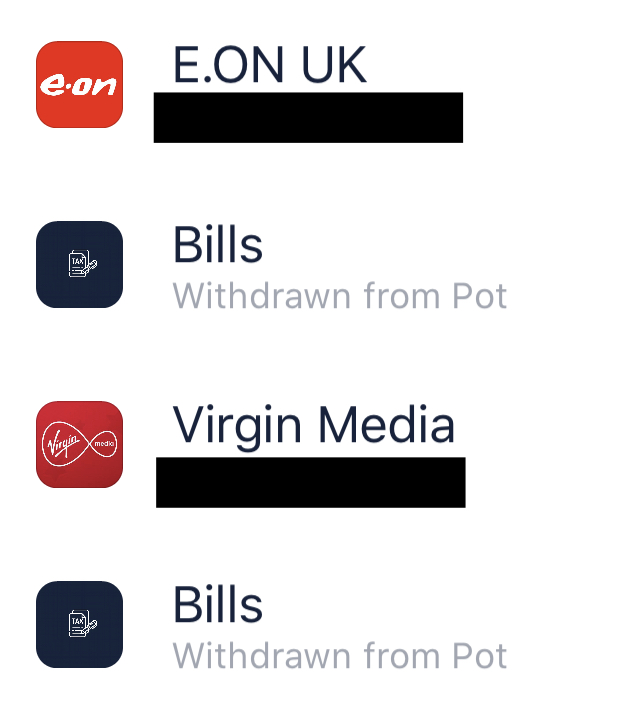

I’d like a way to have the withdrawal from a pot, and the bill payment merged into a single item in the transaction list. It gets very noisy when bills are paid and there’s multiple transactions shown in the list in the app.

Spending & budgeting observations

The good: 👍🏻

Transport / entertainment / groceries / personal care costs are about what I’d hoped them to be, which is good.

My budget for ‘family’ stuff (which is mainly things for our pets) is fairly accurate, I went a little over as our African Fat-Tailed gecko needed a trip to the vets to make sure she was okay (she is!) - but other than that, things were generally as expected.

The not-so-good: 👎🏻

I’ve spent more than expected in the shopping category. With Valentine’s Day and an upcoming birthday, I hadn’t really considered budgeting anything for buying gifts in the shopping category.

We’ve been reducing the amount we spend on eating out / takeaway recently, but still spent too much. We’ve been (mostly) sticking to meal plans which has helped a lot - but habits can be hard to break. Plus there was a couple of celebratory meals out this month for different reasons.

Pots

I’ve setup more pots, with a mix of ongoing / short (weeks) / medium (months) / long (1 year+) term uses.

I’m using pots as a more ephemeral way of setting money aside. In March I have a few events coming up and I’m trying out locked pots to set money aside for those things that will unlock on the day of the event. Once the events have come and gone, I’ll either remove the pots, or rename them for the next thing I need to set money aside for.

Doing this allows me to:

- Better budget what I’m hoping to spend for each event by thinking about it beforehand

- Ensure that I set the money aside and don’t spend it

I also found some amazing pot images through the Monzo Saving Squad Facebook group and have been using them for my pot images

My pots as of the end of February 2020 are:

-

Coin Jar

Ongoing regular pot, used for transaction round-ups.

-

Bills

Ongoing regular pot, used to put money into using the salary sorter for bills via Direct Debits / Standing Orders / IFTTT card payments each month.

-

Set Aside

Ongoing regular pot, used as a place to set money aside that I’d like to keep in addition to my regular savings each month. It’s kind of a contingency pot of “I’d like to save this, but it’s there just in case” - at the end of the month I move any remaining money to my savings pot.

-

Savings

Ongoing ‘Easy Access’ pot, used as a place to put savings into that I can earn some interest on.

-

Stag Do

Short-term locked pot, used as a place to put money aside for an upcoming stag do for a friend.

-

Watch

Long-term pot, used as a place to put money aside for a new watch (or two…) I’ve got my eye on. 👀

-

Paris Spending Money

Short-term, used as a place to set money aside for an upcoming trip to Paris with my fiancée for her birthday.

-

Birthday Stuff

Short-term, used as a place to set money aside for a pre-Paris birthday gathering with friends.

IFTTT

I’ve been using IFTTT in some form or another since 2012, it’s been a fantastic way to automate stuff without having to build everything myself.

I’ve been tinkering with what I can do with Monzo and IFTTT, I’ve setup a number of applets to help manage things.

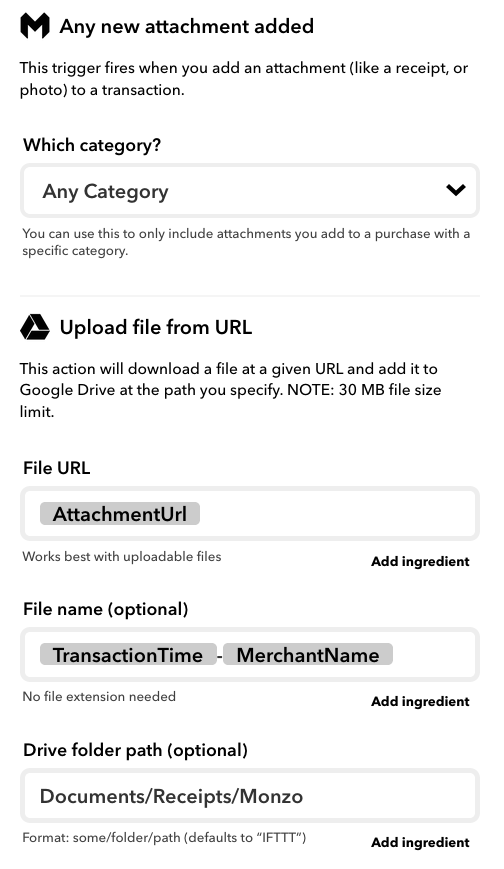

When a receipt is added to a transaction, upload it to Google Drive

I’d like a way to change the date format so they can be better ordered in the folder (something like ISO8601 would be nice instead of the February 1, 2020 at 1224PM format it currently is) but it’s not a deal breaker!

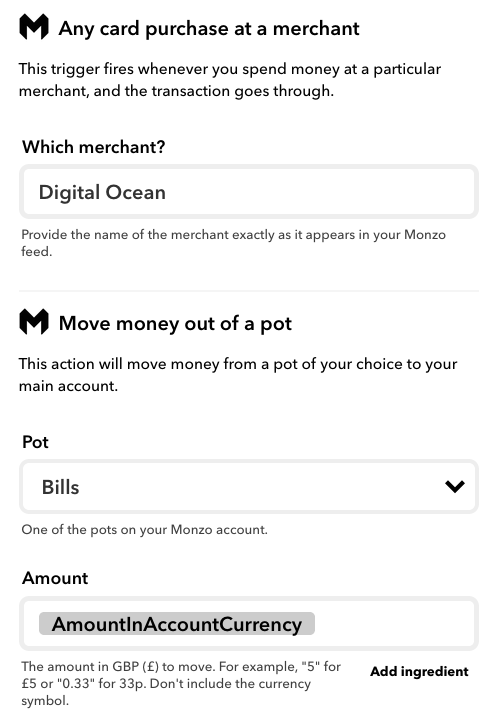

Card payments from pots

Monzo doesn’t natively support card payments from pots, so I’ve setup my repeating card payments to come out of my bills pot using IFTTT.

This will make the payment, then it’ll take the money out of the pot after the payment is taken. It’s different to Direct Debits / Standing Orders being paid from pots where the money is taken out of the pot first, however due to the nature of card payments, Monzo can’t know when the payment will go out to move the money out of the pot beforehand.

In conclusion

I hadn’t considered some recent events, so my spending in a couple of categories was much higher than I’d have liked it to be. However, I’m now using pots to set money aside for upcoming things and planning better beforehand.

The bills pot is the best thing I’ve done with Monzo, and the IFTTT integration to take card payments out of a pot is useful for recurring card payments that can’t be taken out of a pot natively.

I’d like the ability to re-order pots, but that’s a ’nice-to-have’ rather than a ‘must-have’

#FullMonzo after one month has been fantastic.

Disclaimer: I am a Monzo investor